Breaking Down Retirement Plans

January 11, 2021NIRS Releases Pensionomics 2021

January 12, 2021What is the Defined Benefit plan?

A Defined Benefit (DB) retirement plan, or pension, uses a predetermined formula to calculate the amount of the employee’s retirement benefit. Essentially, you get out what you put in. The amount of the retirement benefit to be paid is determined by certain factors (such as years of service and final average salary), not on investment returns and account balances.

Employers (school boards) and teachers contributed to a DB plan administered by the Teachers’ Retirement System of Louisiana (TRSL). TRSL pooled the contributions together and professional asset managers invested the money. These contributions and the interest earned on TRSL investments pay for future retirement benefits.

Now, retired teachers receive a guaranteed amount every month for the remainder of their lives, as guaranteed by the state constitution, per Article X, Section 29 (A).

Why does LRTA support it?

Pensions provide a modest yet reliable retirement income. Because of the reliability a pension provides, studies have found beneficiaries are able to significantly contribute to their local and state economies. The National Institute on Retirement Security reported, for Louisiana, each dollar paid out in pension benefits supported $1.42 in total economic activity in 2018.

The majority of money used to pay for benefits come from investment earnings and employee contributions. Taxpayer contributions are a small source of financing for retirement benefits. Still, NIRS found that each dollar in taxpayer contributions to Louisiana’s state and local pension plans supported $4.09 in total output in the state in 2018.

Research also shows DB plans are an effective recruitment and retention tool for employers. They can assure their potential employees a guaranteed benefit at the time of retirement. Pensions attract both up-and-coming teachers and experienced teachers alike.

Why do people want to change it?

Keep in mind, no retirement plan was perfect from its inception. Business and government constantly examine retirement plans to provide adequate benefits for retirees and, at the same time, control employer costs that provide for a stable and viable system.

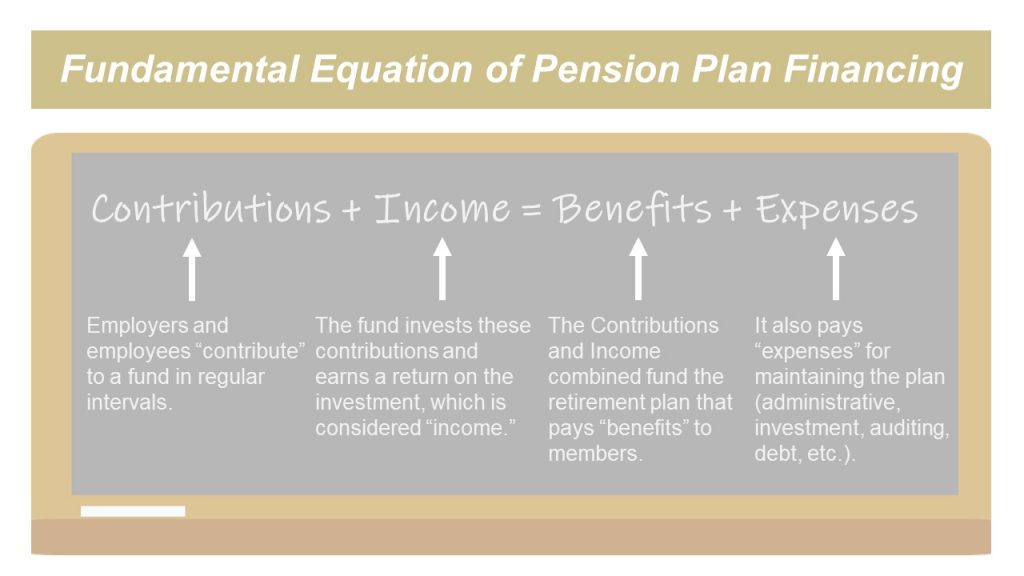

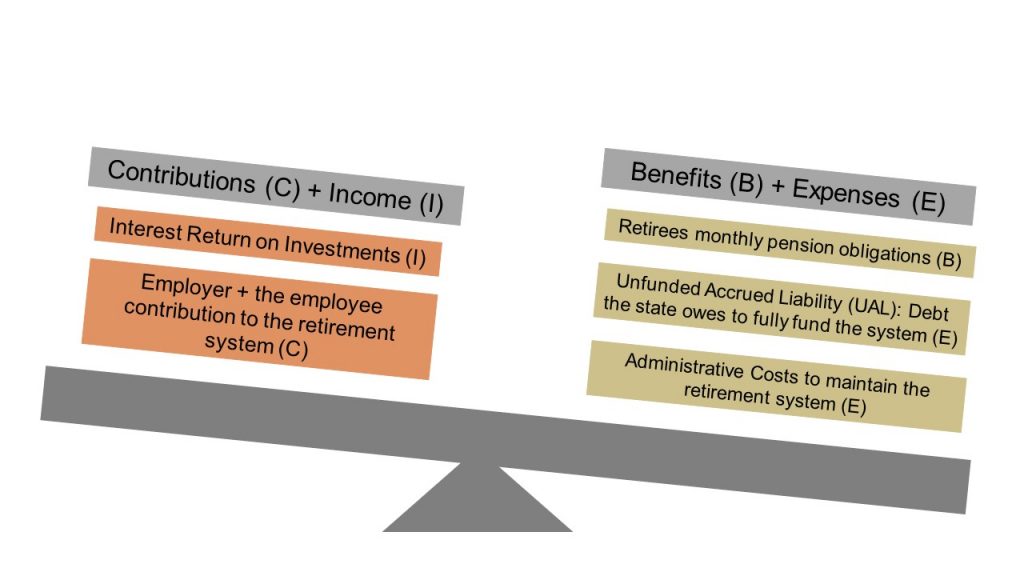

Retirement plans are financed through the formula: Contributions (C) + Income (I) = Benefits (B) + Expenses (E)

Currently, the benefits and expenses (B + E) of the system outweigh the contributions and income (C + I). Our system is only 67.9% funded. The scale is tipped due to a large debt referred to as the UAL (Unfunded Accrued Liability). Legislators have concerns that the investment income will not produce enough funding to balance the B + E.

For many years, state legislators have cited costs and the Unfunded Accrued Liability (UAL) or debt as reasons for switching retirement plans. The authors of the bills stated Defined Contribution (DC) and/or hybrid plans would reduce the financial risk of the retirement system. However, no research or studies show this to be true. In fact, several studies have shown that switching retirement plans can be costly and increase the debt. Switching from a DB plan to another plan will not reduce the current obligation currently owed to the state’s retirement systems.

Plus, switching plans could affect employer and employee contributions to the system. This could mean less money would be available that can go toward paying down the debt, the Experience Account, etc. Changing the current DB plan undermines the financial stability of the trust and could result in reduced or lost benefits to retirees statewide.

Why should we defend it?

Defined Benefit plans provide stable and secure retirement benefits for retired teachers and public employees, which allow them to contribute to their local and state economies. Because contributions are pooled together and specifically invested for the long-term, pensions can overcome the ups and downs of the market. The volatility of the stock market does not directly affect the benefit amount a retired teacher would receive in the future.

DB plans are an effective recruitment and retention tool. Employers can assure their potential employees a guaranteed benefit at the time of retirement. Research shows pension benefits are attractive to teachers and that reducing these benefits could cause them to leave the profession.

There is no DC or hybrid plan currently implemented that provides benefits greater than or equal to the current DB plan or Social Security benefits (note: teachers do not pay into Social Security).

Switching from the current DB plan to a DC or Hybrid plan could accrue additional costs to administer. The legislature has already enacted pension reforms in the past that help reduce the debt, which keeps the retirement system healthy. Even during times of turbulent stock markets, the retirement system has remained stable. Changing the current plan could also result in reduced or lost benefits to retirees statewide.

Research:

Pensionomics 2021 | Measuring the Economic Impact of DB Pension Expenditures – Dan Doonan, Ilana Boivie; NIRS

State and Local Employees Views on Their Jobs, Pay and Benefits – Kelly Kenneally, Tyler Bond; NIRS

-

Full Report: https://www.nirsonline.org/wp-content/uploads/2019/11/NIRS_OR_PublicEmployee2019_FINAL-1.pdf

-

Specific to Teachers: https://www.nirsonline.org/wp-content/uploads/2019/11/Teacher_FactSheet_FINAL.pdf