It’s important to understand the different types of retirement plans, especially if there are proposed changes to the current plan. LRTA breaks down three often-discussed retirement plans: defined benefit, defined contribution and hybrid retirement plans.

Defined Benefit (DB) Plan

Aka Pensions

A Defined Benefit (DB) retirement plan, or pension, uses a predetermined formula to calculate the amount of the employee’s retirement benefit. Both the employer and employee contribute to the plan.

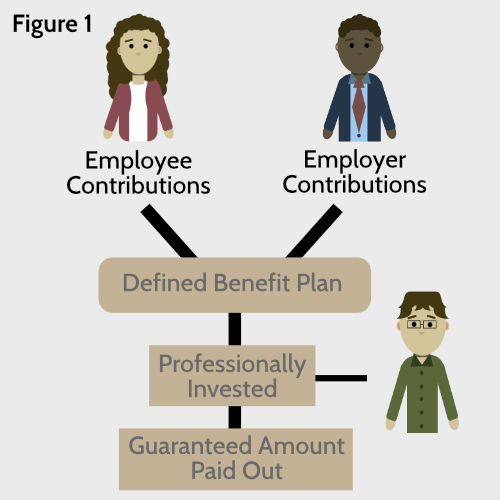

Throughout their careers, teachers and their employers (school boards) contributed to a pension plan administered by The Teachers’ Retirement System of Louisiana (TRSL). TRSL pooled all employee and employer contributions together and professional asset managers invested the money (see Figure 1). These contributions and the interest earned on TRSL investments pay for future retirement benefits.

When the teacher retired, TRSL applied a formula based on their years of service and final average compensation and a benefit factor (a percentage used to calculate the retirement benefit) to determine the monthly benefit amount.

Retired teachers receive a guaranteed amount based on this formula every month for the remainder of their lives, as guaranteed by the state constitution, per Article X, Section 29 (A).

Pension contributions are pooled together and specifically invested for the long-term, meaning pensions can overcome the ups and downs of the market. The volatility of the stock market does not directly affect the benefit amount a retired teacher would receive in the future.

Defined Contribution (DC) Plan

Aka 401(k) or 401(k) style plan

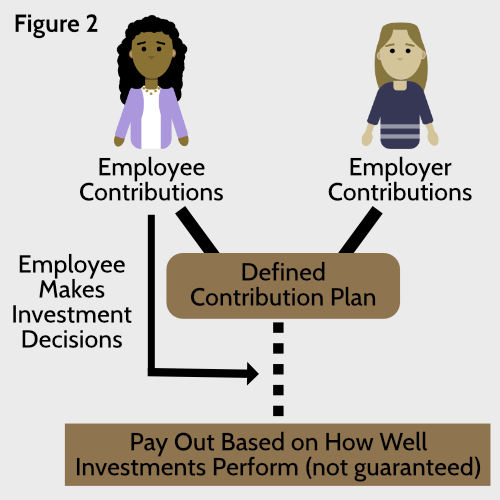

Defined Contribution (DC) plans are similar to 401(k) style plans. Employers and employees can contribute to the DC plan. However, it is up to the employee to make investment decisions themselves. Oftentimes, employees have different portfolio options to choose from to make their investment decisions (Figure 2).

The retirement benefit from a DC plan is not a guaranteed amount. DC plans base the amount of the monthly benefit to be paid on the balance of funds in the individual’s retirement account at the time the decision is made to terminate employment. The balance of the account is normally annuitized. The amount of the balance, plus an assumed rate of interest to be earned over the life expectancy of the retiree, determines the monthly benefit. Depending upon how the plan is established, should downward market fluctuations reduce the account balance, the monthly retirement benefit could also be reduced. Ultimately, the retirement benefit amount is dependent on how well the employee’s investments performed.

Hybrid Plan

Hybrid plans combine the features of Defined Benefit (DB) and Defined Contribution (DC) plans. The money employees and employers contribute to a hybrid plan are split between a DB and DC plan. The DB portion of a hybrid plan is smaller than a traditional pension plan. The benefit factor, or accrual rate, is lower than the typical benefit factor of a traditional DB plan. Because the benefit factor is smaller, the guaranteed payout of the DB portion of a hybrid plan is generally lower. The amount of money available from the DC portion is dependent on how well the employee’s investments performed.