The Government Pension Offset (GPO) and Windfall Elimination Provisions (WEP) are Social Security provisions which impact individuals who have chosen to serve their school boards, towns, cities, counties and states in public jobs. If a retired teacher in Louisiana is entitled to Social Security, the GPO and/or WEP unfairly reduces their Social Security benefit. The GPO and WEP are federal provisions that reduce retired public employee’s individual Social Security and/or survivor benefits.

These provisions impact retired teachers and public servants in Louisiana and other states, such as Alaska, California, Colorado, Connecticut, Illinois, Kentucky, Maine, Massachusetts, Missouri, Nevada, New Mexico, Ohio, Rhode Island, and Texas. Non-public employees with private pensions get to keep their entire Social Security benefit and their Social Security survivor benefits.

How does the GPO work?

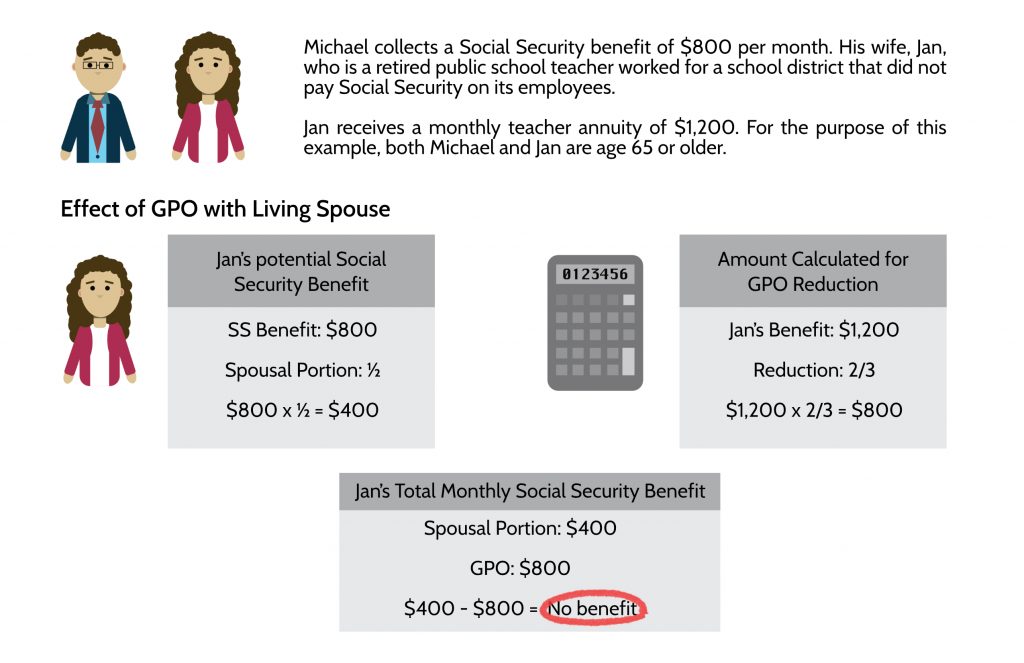

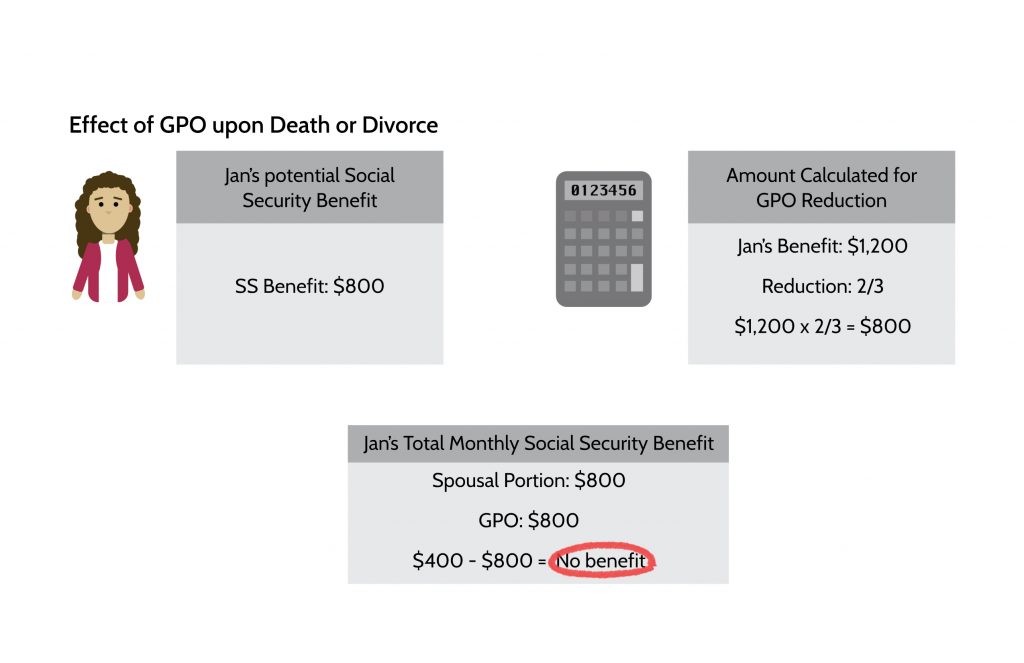

The Government Pension Offset (GPO) eliminates or reduces the spousal benefit by an amount that is determined using a formula which factors in the amount of a teacher’s retirement benefit. This reduction occurs whether the Social Security receiving spouse is alive, deceased, or divorced. Remember, the GPO only impacts those individuals who were not eligible to retire prior to December 31, 1982 (at least age 55 and twenty years of credible service).

The GPO reduces, or often eliminates, the spousal benefit by two-thirds the value of a teacher’s retirement benefit. In many cases, retired teachers are unable to draw any spousal or survivor benefits once the GPO is applied. The following examples help clarify how the GPO may affect an individual in these different circumstances.