Member Spotlight: Sherri Kelley Barber

February 1, 2023Becoming Your Best Advocate: How to Reach Out to Legislators

February 24, 2023Louisiana’s retired teachers devoted their careers to serving the children and state of Louisiana. Their retirement benefits are hard earned and well deserved.

This is why it is important to understand the legislative issues that could impact the retirement benefits of retired teachers. Oftentimes, there is legislation filed at the state level that could result in reduced or lost benefits to retirees or damage to the trust of the retirement system. In addition, there are some federal provisions in place that unfairly penalize retired public servants (of which, LRTA is working to repeal). Understanding the issues is key for effective advocacy.

State Issues

Protecting the Current Defined Benefit plan and retirement system structure

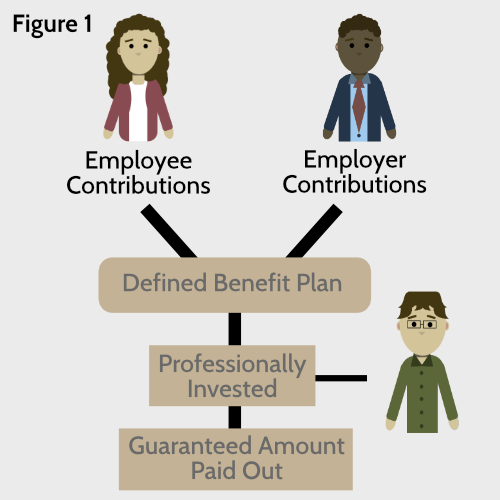

A Defined Benefit (DB) retirement plan, or pension, uses a predetermined formula to calculate the amount of the employee’s retirement benefit. Research shows DB plans are an effective recruitment and retention tool for employers as pensions provide a modest yet reliable retirement income.

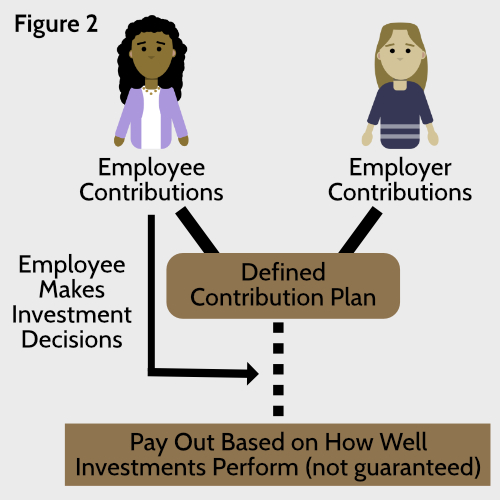

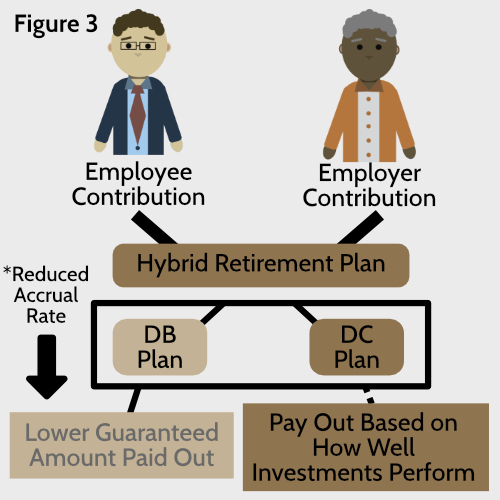

For many years, state legislators have cited costs and the Unfunded Accrued Liability (UAL), or debt, as reasons to switch from the current DB plan. The authors of the bills stated Defined Contribution (DC) and/or hybrid plans would reduce the financial risk of the retirement system. However, several studies have shown that switching retirement plans are actually costly to retirement systems and increases the debt. Switching to a different retirement plan will not reduce the current obligation currently owed to the state’s retirement systems. Plus, switching plans could affect employer and employee contributions to the retirement system, which could lead to less money being available to go toward paying down the debt, the Experience Account, etc. Changing the current DB plan compromises the financial trust and could result in reduced or lost benefits to retirees statewide.

There is no DC or hybrid plan currently implemented that provides benefits greater than or equal to the current DB plan or Social Security benefits (note: teachers in Louisiana do not pay into Social Security). Even during times of turbulent stock markets, the retirement system has remained stable. LRTA continues to advocate to protect and maintain the current DB plan as well as preserve the financial trust of the retirement system.

Cost-of-living Adjustments (COLAs)

Cost-of-living adjustments, or COLAs, are granted on an ad hoc basis for Louisiana’s retired teachers. If the retirement system meets certain requirements AND there is enough money in the Experience Account (an account designed solely to hold funds for COLAs) AND the Louisiana legislatures approves the retirement system granting a COLA, then eligible retired teachers may receive an adjustment in benefits (also known as a permanent benefit increase). The amount of the increase is tied to the funded status of the retirement system and is set by state law. Eligible retired teachers received a two percent COLA in 2022.

Currently, the Experience Account is funded solely through excess investment earnings realized by the retirement system AFTER it has paid all obligations and debt. Even if funds are available and all other requirements are met, the Louisiana legislature still must approve granting the COLA. This is one of many reasons why it is important that Louisiana’s retired teachers have a strong voice at the state Capitol. Not only to advocate for the hard-earned benefits of retired teachers, but also to advocate for reforms that would allow for regular, stable COLAs retirees can rely on into the future.

Investments

Along with employer and employee contributions, the current defined benefit plan is funded through investment earnings. The Teachers’ Retirement System of Louisiana (TRSL) invests portions of the employer and employee contributions and use the investment earnings (along with the employee and employer contributions) to fund retirement benefits. According to a report published by the National Institute on Retirement Security (Pensionomics 2023), nearly 49 percent of Louisiana’s pension fund receipts came from investment earnings.

The retirement system relies on its board of trustees to make fiduciary decisions that will generate reasonable returns while minimizing risk. By definition, these individuals must act in the sole interest of the beneficiary or member. This means that other considerations, no matter how laudable or important, must not impinge on the investment decision process. Restricting the retirement system’s ability to invest in certain companies and make fiduciary decisions could negatively affect the system’s revenue stream and funding.

Constitutional Conventions

Since 1973, per Article X, Section 29 (A), the Louisiana Constitution has guaranteed lifetime retirement benefits to state retirees. A constitutional amendment or convention has the potential to remove this guarantee. Therefore, the state would no longer be required to pay retired teachers pensions (that they EARNED).

Federal Issues

Government Pension Offset (GPO) and Windfall Elimination Provision (WEP)

The Government Pension Offset (GPO) and Windfall Elimination Provision (WEP) are Social Security provisions which impact individuals who have chosen to serve their school boards, towns, cities, counties and states in public jobs. These provisions reduce retired public employee’s individual Social Security and survivor benefits. The GPO eliminates or reduces the spousal benefit by an amount that is determined using a formula which factors in the amount of a teacher’s retirement benefit. This reduction occurs whether the Social Security receiving spouse is alive, deceased, or divorced. Remember, the GPO only impacts those individuals who were not eligible to retire prior to December 31, 1982 (at least age 55 and twenty years of credible service).

The WEP uses a modified formula that may reduce your earned Social Security benefit. The modified formula applies to you when you attain age 62 or if you become disabled after 1985 and first become eligible after 1985 for a monthly pension based in whole or in part on work where you did not pay Social Security taxes.

The GPO and WEP affect public employees in states that do not participate in the Social Security system. These Social Security benefit reductions affect public employees in virtually every state; however, those states with the greatest impact, in addition to Louisiana, are Alaska, California, Colorado, Connecticut, Illinois, Kentucky, Maine, Massachusetts, Missouri, Nevada, New Mexico, Ohio, Rhode Island, and Texas.

LRTA continues to support any and all repeal of the GPO and WEP.

Research:

Pensionomics 2023 | Measuring the Economic Impact of DB Pension Expenditures – Dan Doonan, Ilana Boivie; NIRS

State and Local Employees Views on Their Jobs, Pay and Benefits – Kelly Kenneally, Tyler Bond; NIRS

- Full Report: https://www.nirsonline.org/wp-content/uploads/2019/11/NIRS_OR_PublicEmployee2019_FINAL-1.pdf

- Specific to Teachers: https://www.nirsonline.org/wp-content/uploads/2019/11/Teacher_FactSheet_FINAL.pdf

Millennial State & Local Government Employee Views on Their Jobs, Compensation & Retirement – Kelly Kenneally, Tyler Bond; NIRS

Teacher Pensions vs. 401(k)s in Six States: Colorado, Connecticut, Georgia, Kentucky, Missouri and Texas – Leon (Rocky) Joyner, Nari Rhee; NIRS