GPO and WEP

Updates on the Government Pension Offset (GPO) and Windfall Elimination Provision (WEP)

What is the GPO/WEP?

The Government Pension Offset (GPO) and Windfall Elimination Provision (WEP) are Social Security provisions which impact individuals who have chosen to serve their school boards, towns, cities, counties and states in public jobs. These provisions reduce retired public employee’s individual Social Security and survivor benefits. The GPO eliminates or reduces the spousal benefit by an amount that is determined using a formula which factors in the amount of a teacher’s retirement benefit. This reduction occurs whether the Social Security receiving spouse is alive, deceased, or divorced. Remember, the GPO only impacts those individuals who were not eligible to retire prior to December 31, 1982 (at least age 55 and twenty years of credible service).

The WEP uses a modified formula that may reduce your earned Social Security benefit. The modified formula applies to you when you attain age 62 or if you become disabled after 1985 and first become eligible after 1985 for a monthly pension based in whole or in part on work where you did not pay Social Security taxes.

The GPO and WEP affect public employees in states that do not participate in the Social Security system. These Social Security benefit reductions affect public employees in virtually every state; however, those states with the greatest impact, in addition to Louisiana, are Alaska, California, Colorado, Connecticut, Illinois, Kentucky, Maine, Massachusetts, Missouri, Nevada, New Mexico, Ohio, Rhode Island, and Texas.

How Does the GPO Impact Retired Teachers?

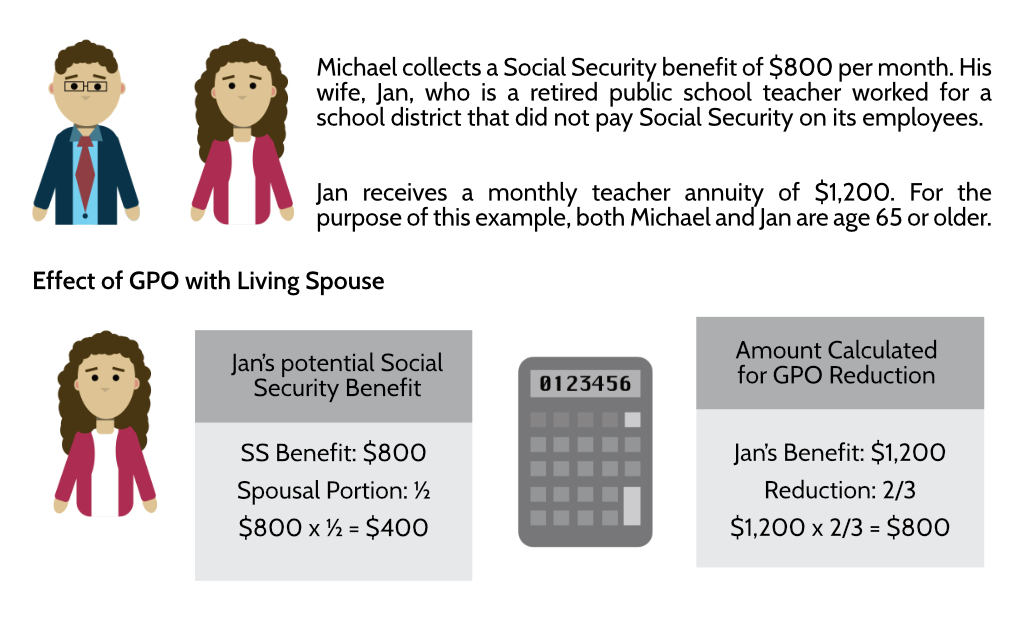

The Government Pension Offset (GPO) eliminates or reduces the spousal benefit by two-thirds the value of a teacher’s retirement benefit. This reduction occurs whether the Social Security receiving spouse is alive, deceased, or divorced. Remember, the GPO only impacts those individuals who were not eligible to retire prior to December 31, 1982 (at least age 55 and twenty years of credible service). The following examples help clarify how the GPO may affect an individual in these different circumstances.

How Does the GPO Affect Retired Teachers?

These examples illustrate a complete offset, whereas in other situations, there may not be a complete offset. It is important to remember that in cases where a complete offset has not occurred, any increase in the teacher’s benefit, even the provision of periodic COLAs from the Teachers’ Retirement System of Louisiana, will result in a recalculation of the Social Security benefit. In other words, as the teacher’s annuity goes up, the Social Security benefit goes down.

How Does the WEP Impact Retired Teachers?

The Windfall Elimination Provision (WEP) uses a modified formula that may reduce your earned Social Security benefit. The modified formula applies to you when you attain age 62 or if you become disabled after 1985 and first become eligible after 1985 for a monthly pension based in whole or in part on work where you did not pay Social Security taxes.

The modified formula is used to figure your Social Security benefit beginning with the first month you get both a Social Security benefit and a teacher’s retirement benefit. However, you can be exempt from WEP if you retired or were eligible to retire prior to December 1985 or have 30 years of substantial Social Security earnings.

The WEP reduction formula does not totally eliminate potential Social Security earnings. In addition, the WEP reduction is not based on how much you earned from other work not covered by Social Security (e.g., your teacher’s retirement benefit). The formula used for calculating the first portion of the Social Security benefit will be reduced if you have less than 30 years of “substantial” earnings in Social Security. Contact a Social Security representative to verify your years of “substantial” earnings and request a calculation of your Social Security benefit. You may also visit www.ssa.gov for more detailed information on the GPO and WEP, and how these offsets are computed.

How Does the WEP Affect Retired Teachers?

What is Being Proposed

Each year, several bills are proposed by members of the U.S. Congress which address the reduction or repeal of both the GPO and WEP. The Coalition to Preserve Retirement Security has information regarding these proposals posted on their website, www.retirementsecurity.org.

In addition, a grassroots organization founded in California–Social Security Fairness–has developed a web site that provides updated information on the repeal initiative. That web site address is www.ssfairness.com. The web site provides a thorough explanation of GPO/WEP, and suggests steps you can take to further the cause for the repeal of these federal statutes.

Proposed Federal Legislation

H.R. 82 – Social Security Fairness Act of 2023

Rep. Garret Graves (R-Louisiana)

Seeks a full repeal of the GPO and WEP. Click here to read the full text of the bill and get updates on cosponsors.

What Can You Do?

LRTA regularly contacts Louisiana’s members of Congress to discuss the hardships the GPO and WEP creates for Louisiana’s retired teachers and public servants and garner their support for a repeal. LRTA also participates in national coalitions with other states affected by the GPO and WEP.

Click here to visit our Action Center where you can find more information about the legislation proposed to address the GPO and WEP and tools to help you contact your members of Congress.